You may do this at the end of the document by: Step 6 – In order to provide the proper Authorization you must Identify yourself and Verify your agreement with the above statement. Step 5 – Enter the Full Name of the Company you are granting permission to deposit payments directly to the Account(s) you have listed in Step 2 (and, if applicable, Step 3) on the blank line in the Acknowledgement/Authorization Statement (just after the words “This authorizes”). Step 4 – Next you must attach the employee’s blank check, inside of the box provided in the center of the form. After the words “Percentage or dollar amount…,” report the Amount to be deposited to this account from the remaining portion of your payment.

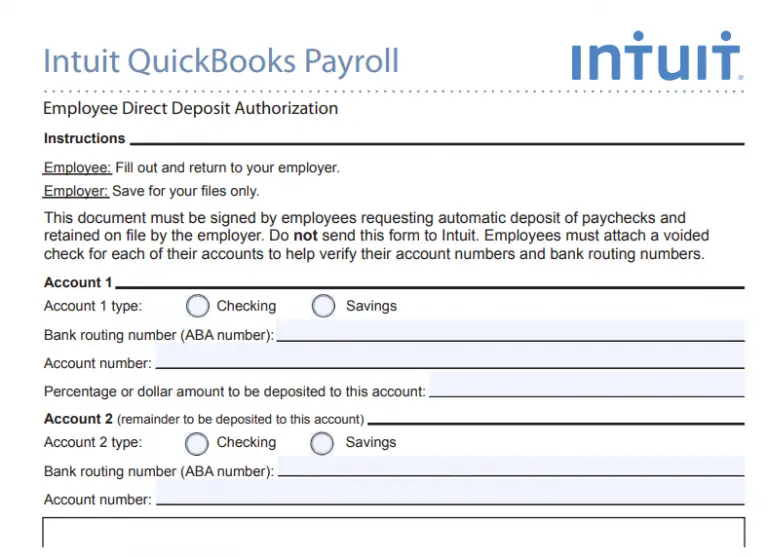

Submit your account number on the third line.Enter the Bank’s Routing Number on the first line in this section.Select the bubble next to the words “Account 2 type” to indicate whether you are reporting a Checking Account or a Savings Account in this section.

Step 3 – If you are choosing to have your payments split between two Accounts, then in the section labeled “Account 2,” you must: Entering a percentage below %100 will mean the balance will either be issued to the Account you define in “Account 2” or, if no second Account Information is entered, issued in check form

Step 1 – Locate the image on the right and select the PDF button below it. Ultimately, it is left up to the Employee to consult with an Employer’s Payroll Department on what the proper procedure and paperwork required to set up Direct Deposit payments is. Many Employers who require this form may require a blank voided check to be submitted as well. Also, you will need to Name and Authorize your employer to make such deposits. You will need to decide which Account or Accounts you wish your payment to be deposited to then report the information defining the target Account(s). The Intuit (Quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit.

0 kommentar(er)

0 kommentar(er)